This is everything you need to know about Virginia’s housing market.

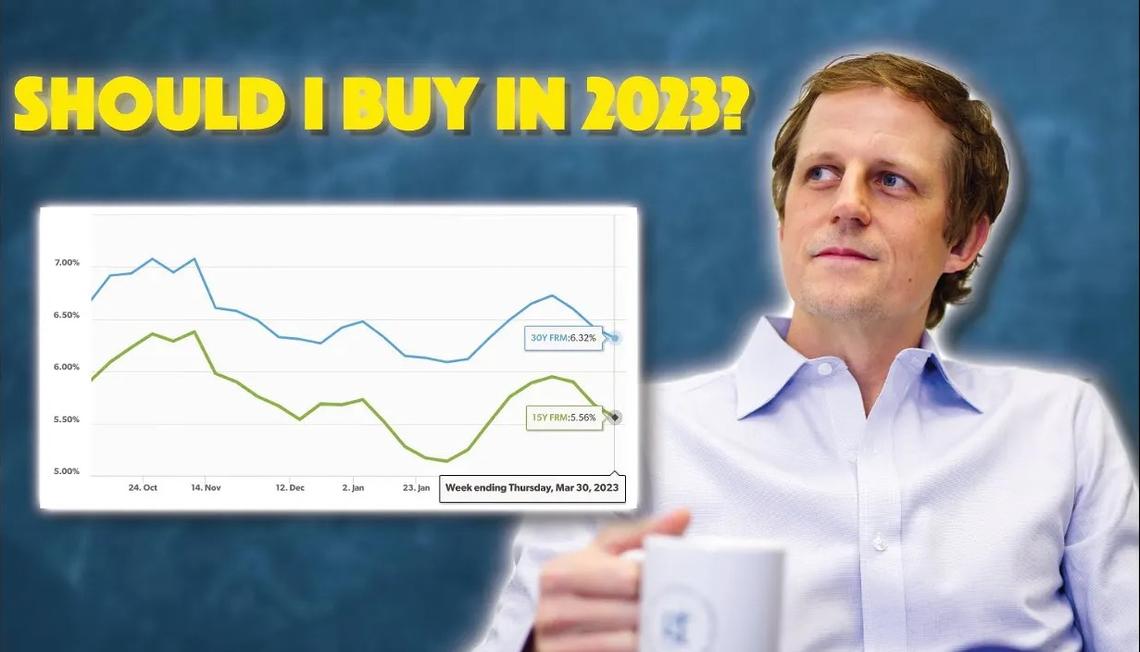

Making financial decisions in a volatile market can be tough, especially when there are so many factors at play. With the first quarter of 2023 behind us, many people are asking questions about what’s happening with banking instability, interest rates, and inventory.

While inventory is down from last year, buyer demand remains high, leading to increased home prices across Virginia. This isn’t the case in all areas of the country. Recent national numbers show seasonally adjusted price decreases in 24 states including hot markets like Nevada and Utah. This is why it’s important to look at local numbers.

The question on many buyers’ minds is whether it makes sense to buy now or wait until interest rates drop. To help answer this question, let’s look at a scenario.

Imagine you’re looking to purchase a $500,000 home with a 6% interest rate, resulting in a monthly principal and interest payment of just under $3,000. If you wait a year for interest rates to potentially drop to 5%, the home price is likely to increase to $525,000 based on current estimates, resulting in a monthly payment of just over $2,800. Let’s look one layer deeper.

“While 24 states have shown price decreases since the peak in 2022, Virginia is still experiencing price appreciation.“

While waiting may save you around $2,000 over the course of a year, there’s a better option. Remember: Marry the House. Date the Rate. By purchasing now and refinancing later when interest rates are lower, you can save in the long run. For example, if you purchase now and refinance in a year, your monthly payment could drop to $2,684 – significantly lower than the $2,800 payment we mentioned for the “waiting” scenario.

Over five years, purchasing now would save you over $8,000 compared to waiting and purchasing at the higher price. And when you factor in the $25,000 you saved by buying earlier, the total difference is well over $33,000.

To make this process even easier, we’ve partnered with top lenders who will refinance our clients’ loans with no lender fees. While there may be some costs associated with refinancing, they are minimal and are far outweighed by the the potential savings.

Don’t be afraid of jumping into our current market. We’re seeing a ton of success for buyers working with our team. The added benefit of working with a trusted lender to refinance – WITH NO FEES – when rates do eventually go down is a huge bonus. Your wallet will thank you in the long run. Remember, if you have any questions about the state of the market or real estate in general, please feel free to contact us by phone or email. We’re running these numbers for people daily – let’s see how they apply to your situation.

Welcome! By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.

Welcome! By submitting information, I am providing my express written consent to be contacted by representatives of this website through a live agent, artificial or prerecorded voice, and automated SMS text at my residential or cellular number, dialed manually or by autodialer, by email, and mail.